Message from the President

Doubling the excitement with favorable results in the first year of the Mid-term Management Plan

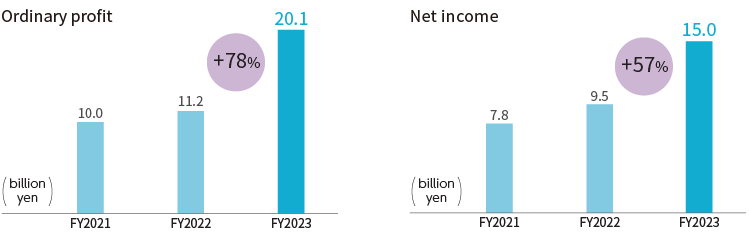

FY2023, the first year of the second phase of the Mid-term Management Plan (FY2023-FY2025), has ended. Marking a strong start, we have seen two consecutive fiscal years of profit growth, with a78% increase in ordinary income and a 57% increase in net income on a year-on-year (non-consolidated) growth rate.

In last year’s Integrated Report, I said, “I am excited about the realization of the new Mid-term Management Plan as we change from the phase of management reorganization and consolidation to a new phase where we will start a full-scale re-growth trajectory.” . This excitement has only grown stronger.

The goals set in the Mid-term Management Plan were not easy to achieve, and I was uncertain how well my excitement would resonate with the employees. However, after achieving many of the targets in the first year, and achieving a significant increase in profits of over 50%, I believe that the employees have gained a great deal of confidence.

As I visit our branches, I often hear “I feel optimistic about SURUGA’s future” and “I enjoy my job.” The employees themselves feel that the company is shifting from the phase of consolidation to a full-scale growth, and it is no exaggeration to say that the excitement has spread throughout the entire company, and more than doubled in size.

Ordinary Income & Net Income

Implications for sustainable growth in the future

Although the first year of the Mid-term Management Plan was satisfactory in terms of profit and single-year performance, I am placing more emphasis on the balance sheet— essentially, how the bank’s basic strength as a bank is developing. In this respect, I believe that FY2023 was a strong year for SURUGA, indicating the sustainable growth moving forward.

The first is the loan balance. Since 2019, we have been working to rebuild our operating base with the aim of transforming the quality of our loan portfolio. These efforts are beginning to show results, with the loan balance reversing from a decline to an increase in the second half of FY2023. This will further boost future earnings.

Secondly, the improvement of credit quality. Through our quality improvement efforts, the disclosed ratio of claims under the Financial Reconstruction Law ratio has gradually declined, reaching a single-digit percentage of 9.8% at the end of FY2023. Although still high, we believe we are making steady progress in improving credit quality.

The third is securities management. Since FY2022, we have been reducing bonds and multi-asset funds with unrealized losses in order to improve the quality of our securities portfolio. As a result, the portfolio switched to a valuation gain of 21.7 billion yen at the end of FY2023.

The fourth is the capital adequacy ratio. As the world is shifting to a world with interest rates, securing a sufficient capital buffer to enable the necessary risk-taking will lead to expectations of future growth.

Most importantly, it is truly wonderful to see that our employees have begun to focus on the same direction as management with high motivation. Since there is no perfect score for basic strength, we will continue our efforts for further improvement.

The most significant achievement of the first year of the Mid-term Management Plan: Progress of the Yatsugatake Model

Last year, I mentioned that we would shift from the Mt. Fuji Model to the Yatsugatake Model, that is, to a business model with multiple growth engines, rather than relying on a single growth engine. I believe the most significant achievement of the first year of the Mid-term Management Plan was the favorable progress in this direction.

Specifically, while our strength in investment real estate loans was natural, the amount of new transactions for housing loans and unsecured loans increased by double digits compared to the previous year, and the amount of new assets under custody, including investment trusts and insurance, nearly doubled. The product lines held by the four autonomous profit centers, namely Community Banking, Direct Banking, Greater Tokyo/Wide Area banking, and the Market Finance Division, all showed significant growth.

Behind this success is, as always, the growth of our employees. In addition to the increased speed of decision-making and action, we believe that the shift from short-term thinking that pursues results in a single year to medium- to long-term thinking that aims for sustainable growth has led to the favorable results for the single year.

Envisioning where we want to be in 10 to 20 years with a healthy sense of urgency

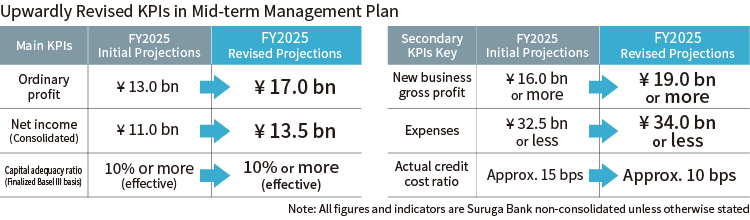

Because the favorable performance in FY2023 was not a one-time event, but rather an indication of sustained growth in the future, we have revised upward the KPIs (Key Performance Indicators) of this plan even though only one year has passed since the start of the Mid-term Management Plan. I am confident in sharing that we are on the path to re-growth as outlined in the Mid-term Management Plan, that we are on track to achieve the goals of the Mid-term Management Plan even without relying on external environmental changes such as rising interest rates, and that we now have a solid foundation on which to accomplish 100% of the plan.

Meanwhile, it is important to envision not only the immediate three-year period, but also how we would like to be in 10 or 20 years from now. While it is true that the business environment is beginning to show positive signs with the arrival of the world with interest rates, this does not mean that the competitive environment will slow down. It will become even more important to maintain a healthy sense of urgency without becoming complacent about current performance.

A clue to how we want to be in 10 and 20 years can be found in our corporate philosophy of, “I’m glad you’re here... I’m glad we met.” We need to offer things that does not exist in the world, something that other banks do not do, or people will not be able to say, “I’m glad we met.” Therefore, SURUGA’s mission is to continue to be different from others.

Striving steadily and whole-heartedly to create a difference

In business terms, SURUGA’s “creating a difference” is about differentiation.

I mentioned earlier that the amount of new assets under custody, such as mutual funds and insurance, has grown nearly twofold. We do not sell these financial products as stand-alone products, but are dedicated to money planning that considers the total asset management of our customers. It is easy to talk about money planning, but there are a few companies that diligently put it into practice.

As a result of these efforts, SURUGA has achieved the top position among banks (as of March 31, 2023) in the ratio of customers by investment trust investment profit/loss, one of the indicators to measure the degree of customer-oriented business operations. Although this indicator only represents one aspect of SURUGA’s asset consulting, it does indicate that more and more employees are trying to embody our corporate philosophy by contributing to the expansion of our customers’ asset value and bringing smiles to their faces.

In housing loans, more than half of the loans are made to foreign nationals. This is also one of our differentiators, as this is not common among other banks.

In direct banking, there is a growth in dental loans, with customers signing up directly online. Dental loans have traditionally been contracted through clinics, so we are differentiating ourselves here as well.

Creating a difference is also demonstrated in the way customers are treated. While financial institutions used to give the impression of being overly polite and formal, SURUGA takes a friendly approach to make our customers feel comfortable.

The words “differentiation” and “creating differences” may sound like something extremely far-fetched. However, SURUGA intends to pursue creating a difference that cannot be found anywhere else by working steadily and whole-heartedly not only in terms of products but also in terms of intangible aspects, such as the way we treat customers and the way we offer advice.

Pursuing business differentiation even in a “world with interest rates”

Of all the changes in the environment surrounding our business, we are focusing most closely on a “world with interest rates.” The impact of rising interest rates on earnings is generally positive. In particular, in our case, the positive impact of higher interest rates is expected to emerge relatively quickly, given that the percentage of corporate loans is small at around 20%, the majority of loans are at floating interest rates, along with relatively low securities risk.

However, it is necessary to consider two things without being carried away by the idea that this will have a positive effect.

First is the impact of rising interest rates on our customers. For those negatively impacted by rising interest rates, we will promptly consult with them and offer support so that they can truly feel our corporate philosophy, “I’m glad you’re here.” We believe that now more than ever is the time for the true value of SURUGA’s corporate philosophy to be tested.

The second is to build a business model that does not rely on rising interest rates. When interest rates rise and earnings improve, it is easy to be reassured that everything will be fine. However, as mentioned earlier, competition in the banking industry is intensifying. Those outside the banking industry are entering the market one after another, and we cannot survive if we rely solely on rising interest rates. We must thoroughly differentiate our business itself in order to overcome the competition.

Considering Japan’s potential growth rate, there are doubts as to whether a high-interest-rate society like those in the West will arrive and persist here. Although there are fewer people making belittling statements about regional banks being a structurally depressed industry than in the past, it is precisely because of this environment that it is necessary to strengthen business models, including the return of the low-interest-rate era.

Steady progress in alliance with Credit Saison

In the Mid-term Management Plan, we set forth three management strategies. These three strategies are “evolving the retail and solution businesses,” “building a sustainable revenue structure,” and “risk-taking and risk diversification.” This fiscal year, the second year of the plan, we will continue to evolve these three strategies, especially focusing on the first strategy, the evolution of the retail and solution businesses.

Again, we emphasize creating a difference. We intend to take it to the next level with our sights set on the next Mid-term Management Plan. One of these strategies is our alliance with Credit Saison.

A year has passed since we formed a capital and business alliance with Credit Saison. Our goal is to become a Neo Finance Solution Company that addresses all kinds of problems and deficiencies, aimed at creating a difference. The effects of the alliance have been more rapid than initially anticipated.

The annualized pace of our mortgage and investment real estate loan business, which we began last fall, is approximately 55 billion yen, and we expect to accumulate more than 350 billion yen in total new loan volume by FY2027. We have announced that the gross profit effect of the various measures combined will be more than 2 billion yen in FY2025, but we expect the amount to exceed our forecast.

In addition, communication among not only top management but also front-line employees has deepened, and new ideas for products and businesses have continuously emerged, creating a positive cycle that has spontaneously expanded business alliances.

I have also interviewed members on loan to SURUGA and employees dispatched to Credit Saison about the strengths and weaknesses of SURUGA and differences between the two companies, and they all say that the corporate cultures are similar and that they are easy to adapt to. Meanwhile, they also say that because of the different business conditions, the way of conducting business is completely different, and that this is where they have the opportunity to learn new things.

In the future, we intend to promote more multi-layered personnel exchanges and deepen our consideration of medium- and long-term business models. Specifically, we have established three priority areas: product and service collaboration, marketing sophistication, and joint utilization of management resources. We are considering various initiatives and measures in these areas, particularly the joint use of business infrastructure and IT tools from the perspective of improving efficiency.

Laying groundwork for the future: SURUGA’s human capital management and investment in growth

One of the KPIs revised in the Mid-term Management Plan KPI is expenses. The FY2025 expense plan was originally set at 32.5 billion yen or less, but the revised plan now calls for 34.0 billion yen or less. Most of the increase is due to personnel expenses.

Although it was not fully anticipated when the Mid-term Management Plan was formulated a year ago, the positive cycle between wages and prices has begun to circulate in Japan, and in FY2023, we provided an inflation-adjusted allowance and raised starting salaries. The changes in the expense plan have been re-estimated to take into account these compensation-related measures that are scheduled to be implemented in the coming years.

However, personnel expenses are not expenses, but rather investments, and we believe that increased investment in human capital will bring medium- and long-term benefits to SURUGA. Although the increase in expenses will have a negative impact on single-year profits, it is an essential investment to enhance employee performance and engagement for sustainable growth.

There were opinions that, “job satisfaction is more important than salary,” but I believe we need both. In other words, we need to make sure that employees are well compensated according to their performance, and we also need to improve employee engagement by providing employment opportunities to a more diverse range of human resources and reforming work styles. We are actively investing in human capital to achieve both of these goals and to become a more appealing company for highly motivated and skilled professionals.

As we promote the shift from the Mt. Fuji Model to the Yatsugatake Model, SURUGA’s business is expanding, and there is a continuing shortage of employees at all of our profit centers. Therefore, while strengthening recruitment is a natural step, we have also introduced measures to support the activities of veteran employees, based on our policy of “hoping for their active participation and contribution of employees until the age of 70.”

This was proposed by the management team after visiting the sales sites and listening to the feedback of employees. When this measure was introduced, an employee who had previously been recognized as a professional with more than 30 years of dedicated administrative experience reskilled to take on the challenge of asset consulting for customers, and is now working as a financial advisor (FA). In addition to reassignment through reskilling, we are expanding systems to encourage experienced employees to play an active role for a long time, such as the Meister System and the elimination of age limits for branch managers and other management positions.

Regarding proactive investment in business infrastructure for the future, investment in people is the most important, but investment in IT platforms and DX promotion is just as important. In order to build a next-generation IT platform with flexible scalability and availability to realize our ever-changing business strategy, we will move forward with the shift to cloud computing for our accounting systems by 2026.

One of the initiatives ahead of this IT infrastructure reform is the integration of physical and remote services. While developing smartphone banking services that are user-friendly for senior customers, we are also strengthening the digitalization of our branches to create a world in which customers are able to use both their smartphones and our branches effectively.

For example, when the family members of a senior living in Shizuoka Prefecture (sons and daughters who work outside the prefecture) want to consult about inheritance and go through the procedures, it is difficult to carry out the complicated procedures remotely. However, it can be done efficiently if they visit our branches located in major cities throughout the country. In this way, we believe that our unique combination of physical and remote services makes banking safe and secure for customers who say that while remote services are sufficient for everyday deposits and withdrawals, they are not comfortable with remote services for important transactions.

Efforts to Achieve a P/B Ratio Above 1.0

●Improving ROE

A P/B ratio in excess of 1.0 is essential for listed companies, and we are working diligently to achieve a P/B ratio in excess of 1.0. Our first priority is to improve ROE (return on equity).

ROE has been improving since bottoming out at the end of FY2021, but was at 5.4% at the end of FY2023, not reaching the minimum level of shareholder equity cost of 6%. Therefore, we have now announced that we aim to achieve ROE of 6% or higher on average from FY2026 onward, and 8% or higher in the long term.

In improving ROE, it is necessary to clearly indicate the timeline. If all that is needed is to increase ROE in the short term, then cost reduction and downsizing is a shortcut. However, this will not lead to medium- to long-term ROE improvement or a clear view of the future. If medium- to long-term ROE improvement is the objective function, growth through differentiation is essential. SURUGA’s policy is centered on growth through differentiation and medium- to long-term ROE improvement. This means that the only way to achieve this is to build a sustainable profit structure through the steady implementation of the Mid-term Management Plan.

●Sustainability Management

In addition to improving ROE, SURUGA will work to achieve a P/B ratio of over 1.0 through improving the expected growth rate and reducing capital costs. We believe that the evolution of the alliance with Credit Saison, as mentioned earlier, will be key to these efforts to improve the expected growth rate.

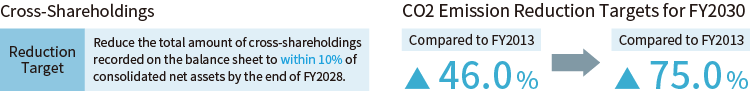

Efforts to reduce the cost of capital include a risk assessment for a world with interest rates, limiting the ratio of policy shareholdings to consolidated net assets to less than 10% within the next five years, and promoting ESG/SDGs initiatives.

In terms of ESG/SDGs, SURUGA is focusing on cycling initiatives. To date, we have concluded partnership agreements with a total of 12 local governments for the promotion of bicycling, and are conducting city promotions, cycling events, and other activities. Cycling contributes to the reduction of greenhouse gas (CO2) emissions, supports local tourism, and improves the health of participants. We plan to further accelerate these efforts.

We will also speed up our decarbonization efforts. SURUGA endorses the Task Force on Climate-related Financial Disclosure (TCFD) recommendations and announced CO2 emissions reduction target in 2021. The Scope 1 + Scope 2 emissions reduction target was set at 46% reduction (compared to FY2013) by FY2030, and we have already achieved a 45% reduction. Based on this achievement, we have now raised the target to a 75% reduction.

Amid growing recognition around the world, including at COP28, that further decarbonization efforts are essential to achieving the Paris Agreement target (2°C target), we provide consulting services to our corporate clients on decarbonization management using tools for visualizing CO2 emissions. We felt it was important to take the initiative and raise our own reduction targets.

Increasing employee engagement and expanding human capital are also crucial. We conduct an annual employee motivation survey to carefully listen to what our employees are thinking and apply it to management. For issues identified through the survey, the management team directly listens to employees’ opinions, delves deeper into the issues, examines countermeasures, and develops specific measures.

Examples include career vision dialogues to encourage young and mid-career employees to think about their own careers, future management schools for developing female leaders, and support for veteran employees, as mentioned earlier.

Through these efforts, SURUGA will strive to improve PBR over the medium to long term.

Enhancing shareholder value with commitment and consistency, following through on our original intentions

Thanks to everyone’s support, the first year of the Mid-term Management Plan was filled with signs of a bright future. SURUGA adopted a basic policy for shareholder return for the first time, implemented a large-scale share buyback of approximately 20 billion yen, and raised the annual dividend per share to 21 yen.

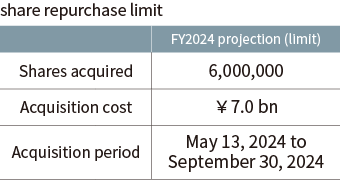

In the first half of this fiscal year, the second year of the Mid-term Management Plan, we continued to perform well and set a new share repurchase limit of up to 7 billion yen. This decision was based on comprehensive consideration of the outlook for achieving the Mid-term Management Plan KPI of a capital adequacy ratio of 10% or more in real terms, future business performance, capital conditions, and opportunities for growth investment.

What I value most is to keeping my word and maintain our original intention in mind.

SURUGA is still in the process of developing our original intention, the corporate philosophy, “I’m glad you’re here... I’m glad we met.” Although we are well on track to achieve the Mid-term Management Plan KPIs, that is not the end goal, and we still need to refine our strategy of creating a difference.

I would like to conclude my message by assuring all of you that I will continue to review and follow through on my original aspirations, as a way of reminding myself to stay focused.

I would like to thank you all for your continued understanding and support.