Structure of borrowing rate and repayment amount for variable interest rate home loans

- Please also refer to [Structure of Variable Interest Rate Home Loans (materials provided by the Regional Banks Association of Japan)].

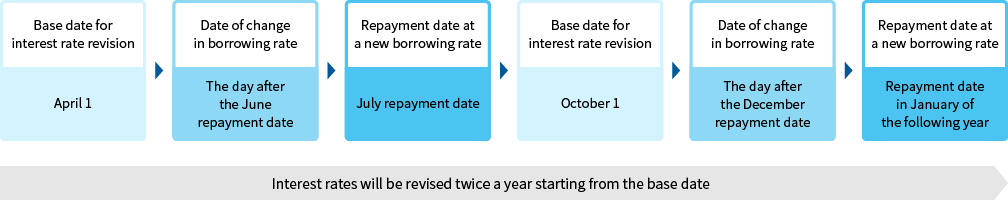

Rules on revising borrowing rates

- Borrowing rates will be revised twice a year on April 1 and October 1 as the base date.

- The borrowing rate after the revision will be applied from the day after the monthly repayment date in June and December.

If the base date is April 1, interest calculated at the revised borrowing rate will be paid from the monthly repayment in July; if the base date is October 1, interest calculated at the revised borrowing rate will be paid from the monthly repayment in January of the following year.

Rules on changing the repayment amount following the borrowing rate revision

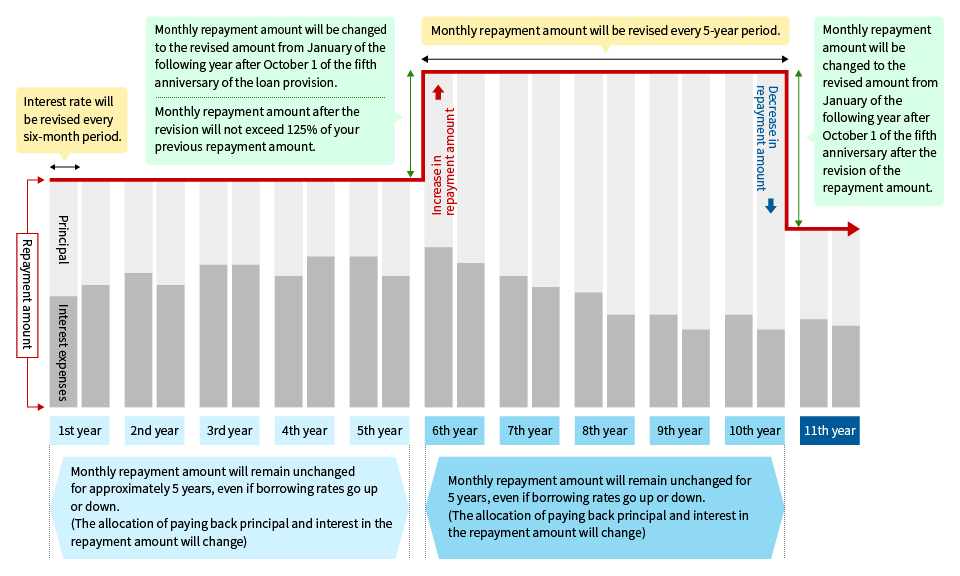

Principal and interest equal repayment method |

Revised repayment amount will be based on the outstanding principal amount and the remaining term of the loan by applying the following revision rules (1) and (2).

- Revision to repayment amount for every 5-year period (5-year rule)

- Monthly repayment amount will be revised every 5-year period after providing the loan and you will pay the certain fixed repayment amount for approximately 5 years.

- Monthly repayment amount will not increase or decrease for approximately 5 years even if borrowing rates go up or down.

However, the allocation of paying back principal and interest in the repayment amount will be adjusted according to the revision of borrowing rates. Therefore, the composition of the repayment amount will be more allocated to paying back the interest portion if interest rates rise, and less allocated to the interest portion if interest rates fall. - The new repayment amount will be applied to the monthly repayment in January of the following year after October 1 of the fifth anniversary of the loan provision. The monthly repayment amount will be revised for every 5-year period thereafter.

- 125% rule

- When revising the repayment amount for every 5-year period, the maximum repayment amount after the revision is up to 1.25 times of the previous amount.

- Even if interest rates rise sharply, the repayment amount after the revision will be not more than 1.25 times of the previous amount.

Illustration of changes in repayment amount for the principal and interest equal repayment method

- This is an illustration of the repayment amount if the interest rates were to rise, and is not intended to suggest future interest rate trends.

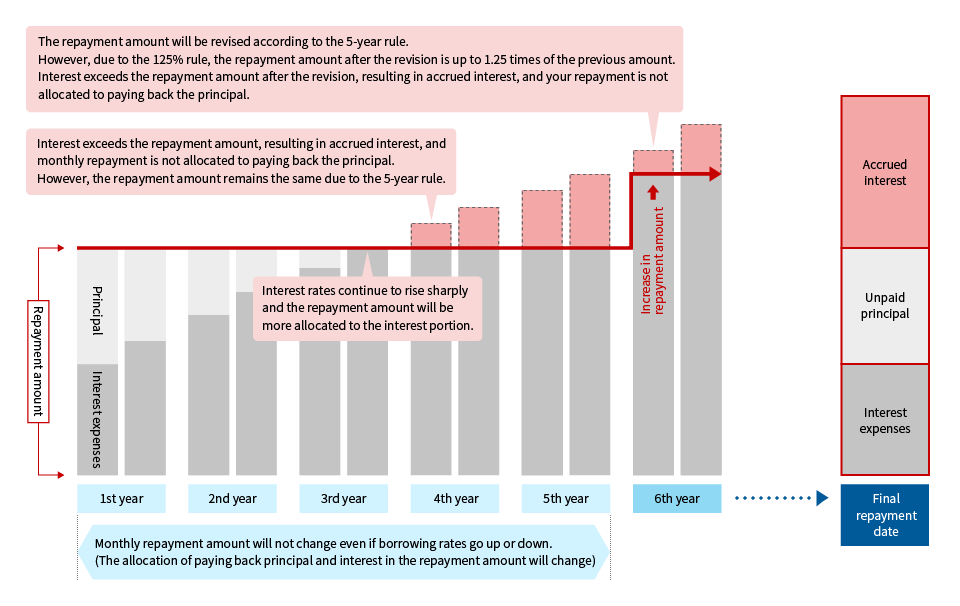

Precautions on accrued interest and illustration

- Interest will be accrued if interest exceeds the repayment amount due to a sharp rise in the borrowing rate.

- If interest is accrued, the repayment amount is not allocated to paying back the principal and payment of interest in excess of the repayment amount is deferred to a later date.

- Please note that even if the repayment amount is revised in accordance with the revision of borrowing rates, if any portion of the accrued interest or the principal remains on the final repayment date, accrued interest and remaining principal are subject to lump-sum repayment on the final repayment date.

- This is an illustration of the repayment amount if the interest rates were to rise or fall , and is not intended to suggest future interest rate trends.

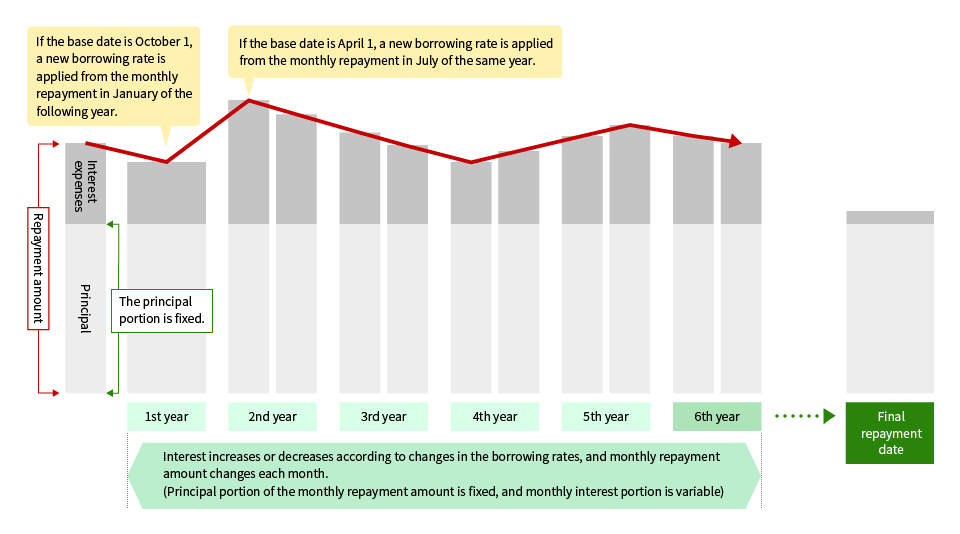

Equal principal repayment method |

- The repayment amount consists of the certain fixed amount of the principal portion and the interest portion calculated at a new borrowing rate according to the rules on revising borrowing rates.

- Please note that unlike the principal and interest equal repayment method, the repayment amount varies each month and there is no cap on the repayment amount if borrowing rates go up.

- If interest rates rise rapidly, the repayment amount may also increase sharply, but no interest will be accrued.

Illustration of changes in repayment amount for the equal principal repayment method

- This is an illustration of the repayment amount if the interest rates were to rise or fall , and is not intended to suggest future interest rate trends.

How to check your borrowing rates and repayment amounts

- Each customer with an applicable loan agreement is sent a revised repayment schedule in May and November of each year. Please check the borrowing rate and repayment amount.

- For details other than the above (repayment method, etc.), please refer to the original loan agreement signed and sealed at the time of the loan contract.